Mudra Loan apply online process begins at official website www.udyamimitra.in. Interested candidates can register themselves by filling Shishu, Kishore and Tarun loans online application form 2026 at the official website. Each applicant can get Mudra loans upto Rs. 10 lakh for credit needs (Rs. 20 lakh on prompt repayment of Tarun loans).

Pradhan Mantri Mudra Yojana (PMMY) is a scheme set up by the Government of India (GoI) through MUDRA (a subsidiary of SIDBI) that helps in facilitating micro credit to small business owners. MUDRA supports Financial Intermediaries to extend loans to the non-corporate, non-farm sector income generating activities of micro and small entities with credit needs. The interventions have been named ‘SHISHU’, ‘KISHOR’ and ‘TARUN’ to signify the stage of growth / development and funding needs of the beneficiary micro unit / entrepreneur.

You can check www.udyamimitra.in Mudra Loan apply online process and avail loans by registering yourself. On making Mudra loan registration at Udyamimitra portal, your application shall be viewed by many lenders for credit support. Read this article till the end to know how to fill Mudra Loan online application form, what are the types of loans, eligibility and other aspects regarding the scheme.

Also Read: PM Vidyalaxmi Scheme Online Registration

Mudra Loan Apply Online Process 2026

Here we are describing complete Mudra Loan apply online process:-

- Firstly visit the official website https://udyamimitra.in/

- At the homepage, go to ‘Mudra loans‘ section and click “Apply Now” tab.

- Direct link – https://site.udyamimitra.in/Login/Register#NoBack

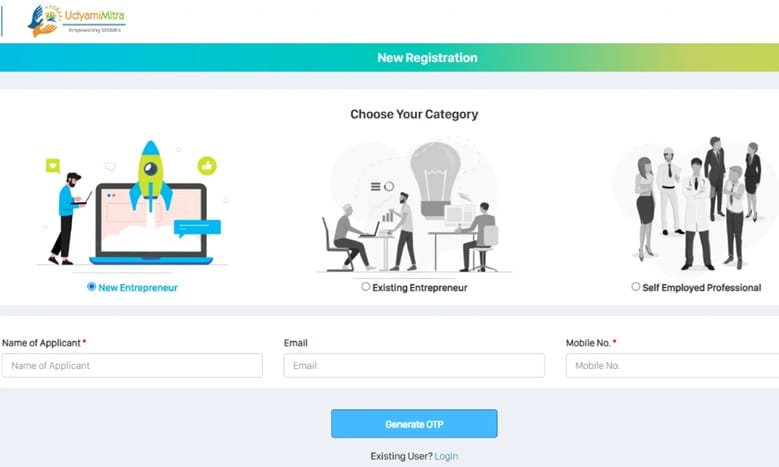

- Upon clicking the link, the Mudra Loan Registration page as shown below:-

- Enter name of applicant, email, mobile number and click “Generate OTP” button.

- Verify the OTP received on the registered mobile number to complete the Mudra Loan online registration process.

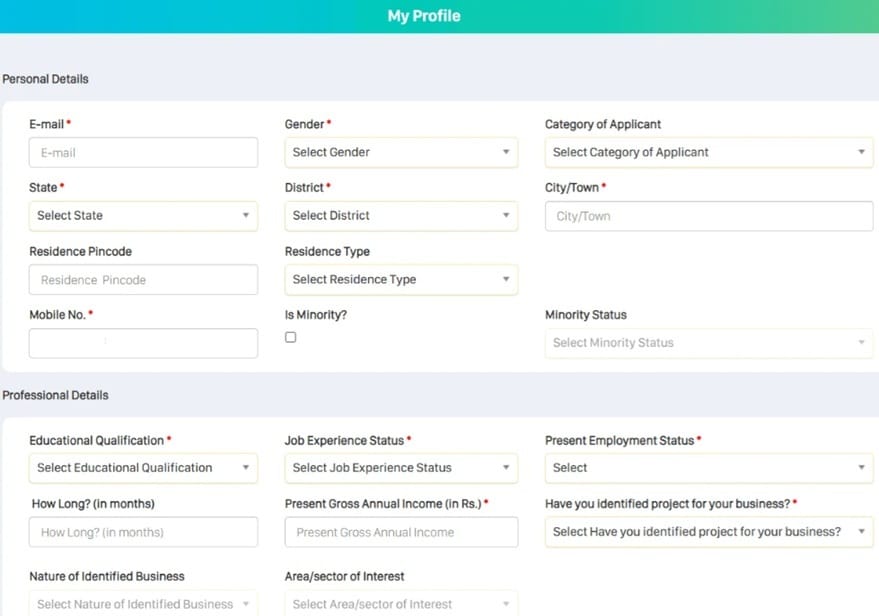

- Afterwards, you can make www.udyamimitra.in login to open Mudra Loan Online Application Form 2026.

- Select gender, category of applicant, state, district, residence type, minority status, educational qualification, job experience status, present employment status, identified project, nature of business, enter email ID, city/town, Pincode, date of birth and other details.

- After filling in the details accurately in the Mudra Loan Online Apply Form, click at “Submit” button.

- After Mudra Scheme online form submission, your application shall be viewed by many lenders for credit support.

- If all the details are found correct, then Mudra loan amount is sanctioned and sent to the applicant’s bank account.

Also Read: Pradhan Mantri Mudra Yojana Application Forms PDF Download

PM Mudra Yojana Eligibility Criteria

The business should be either one of the following:-

- Small manufacturing enterprise

- Shopkeepers

- Fruit and Vegetable vendors

- Artisans

- ‘Activities allied to agriculture’, e.g. pisciculture, bee keeping, poultry, livestock, rearing, grading, sorting, aggregation agro industries, diary, fishery, agriclinics and agribusiness centres, food & agro-processing, etc. (excluding crop loans, land improvement such as canal, irrigation and wells).

Also Read: Standup India Loan Apply Process

Banks / Lending Institutions for Loans under Mudra Scheme

The loans under Pradhan Mantri Mudra Yojana can be availed only through banks and lending institutions which include:-

- Public Sector Banks

- Private Sector Banks

- State operated cooperative banks

- Rural banks from regional sector

- Institutions offering micro finance

- Financial companies other than banks

Also Read: How to Apply for Credit Services under KCC & MISS

Overview of Mudra Loan Scheme

| Name of Scheme | Pradhan Mantri Mudra Yojana (PMMY) |

| Type of Loans | Working Capital and Term Loan |

| Purpose of Loans | Business purpose, capacity expansion, modernization |

| Target Group | Business Enterprises in Manufacturing, Trading and Services sector including allied agricultural activities. |

| Shishu Loans | Loans upto Rs.50,000 are categorized as SHISHU |

| Kishore Loans | Loans from Rs. 50,001 to Rs. 500,000 are categorized as KISHORE |

| Tarun Loans | from Rs. 500,001 to Rs. 10,00,000 are categorized as TARUN |

| Quantum of loan (Min / Max) | Maximum loan amount is upto Rs. 10 lacs (Rs. 20 lakh on prompt repayment of tarun loans) |

| Pricing | Competitive Pricing Linked to MCLR |

| Official Website to Apply Online | https://udyamimitra.in/ |

Also Read: Vidyalakshmi Portal Login

Pradhan Mantri Mudra Yojana Helpline Number

Finding difficult in filling application…. Don’t worry … the www.udyamimitra.in portal will help finding the correct person / right agency to fill the form on your behalf. All you need is to fill in basic personal details with request for agency / person (fees may be charged by the agency / person) on udyamimitra portal. This facility is called as HAVE (Handholding in a virtual Environment). So, if you are planning to set up and intend to apply for loans.

More questions?

Your enquiry (as an applicant, Handholding agency or bankers) can be aptly handled at FAQ (Frequently Asked Questions) section.

Or

Call National Toll Free Number 1800 180 1111/1800 11 0001