Instant E PAN Card apply online form 2026 invited at incometax.gov.in, get new e-PAN through Aadhaar Number. e-PAN is a digitally signed PAN card issued in electronic format based on e-KYC data of aadhaar. e-PAN facility by Income Tax Department of central government is for allotment of Instant PAN (on near-real time basis) for those applicants who possess a valid Aadhaar number. PAN is issued in PDF format to applicants, which is free of cost. Read this article till the end to know how to apply online for Instant E PAN Card with aadhar no.

Instant E PAN Card Apply Online Form 2026

Here is a step by step guide to generate new e-PAN card:-

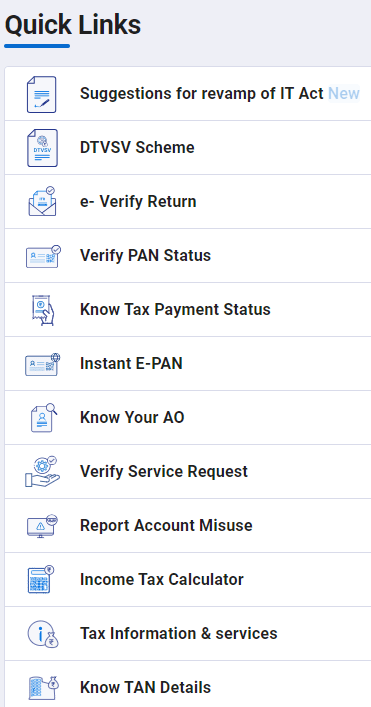

STEP 1: First of all, visit the official website of Income Tax Department at https://www.incometax.gov.in/iec/foportal/

STEP 2: On the homepage of Income Tax department portal, click at “Instant E-PAN” link under ‘Quick Links‘ section.

STEP 3: Direct link for Instant E PAN: https://eportal.incometax.gov.in/iec/foservices/#/pre-login/instant-e-pan

STEP 4: Upon clicking the link, the page showing 2 options – a) Get New e-PAN b) Check Status/Download PAN will open.

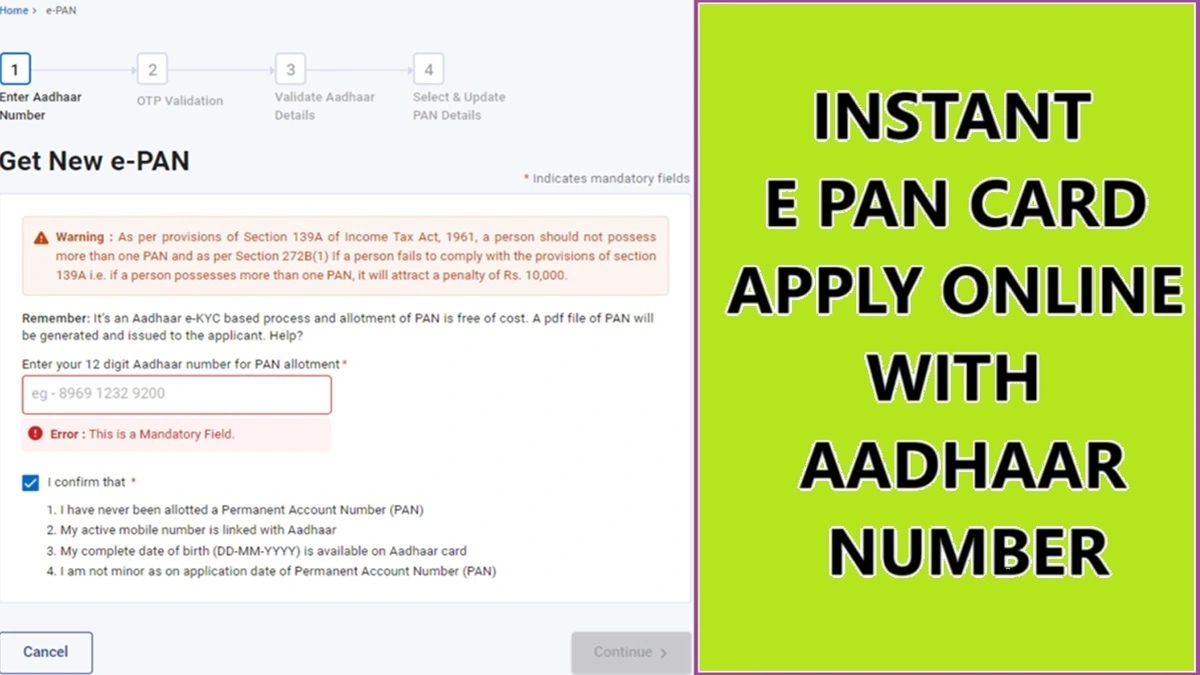

STEP 5: Select the first option namely “Get New e-PAN” to open page where you can apply for e-PAN through aadhaar number.

STEP 6: Enter your 12-digit Aadhaar number, select the “I confirm that” checkbox and click Continue button.

Note:

- If the Aadhaar is already linked to a valid PAN, the following message is displayed – “Entered Aadhaar Number is already linked with a PAN“.

- If the Aadhaar is not linked with any mobile number, the following message is displayed – “Entered Aadhaar Number is not linked with any active mobile number“.

STEP 7: Accordingly OTP validation page will open. Click I have read the consent terms and agree to proceed further. Click Continue.

Step 8: At the OTP validation page, enter the 6-digit OTP received on the mobile number linked with Aadhaar, select the checkbox to validate the Aadhaar details with UIDAI and click Continue.

Step 9: Then the Instant E PAN Card apply online form will open where you can validate aadhaar details.

Step 10: On the Validate Aadhaar Details page, select the “I Accept that” checkbox and click Continue.

STEP 11: On successful submission, a success message is displayed along with an Instant e-PAN Acknowledgement Number. Please keep a note of the Acknowledgement ID for future reference. You will also receive a confirmation message of completion of Instant E PAN Card apply online process on your mobile number linked with Aadhaar.

Eligibility Criteria to Get New e-PAN

- Applicant must have never been allotted a Permanent Account Number (PAN)

- The active mobile number of the applicant must be linked with Aadhaar

- The complete date of birth (DD-MM-YYYY) of applicant is available on Aadhaar card

- Applicant must not be a minor as on application date of Permanent Account Number (PAN)

Note: As per provisions of Section 139A of Income Tax Act, 1961, a person should not possess more than one PAN and as per Section 272B(1) If a person fails to comply with the provisions of section 139A i.e. if a person possesses more than one PAN, it will attract a penalty of Rs. 10,000.

About Instant e-PAN Service

The Instant e-PAN service is available to all Individual taxpayers, who have not been allotted a Permanent Account Number (PAN) but possess Aadhaar. This is a pre-login service, where you can:

- Obtain digitally signed PAN in electronic format, free of cost, with the help of Aadhaar and your mobile number linked with Aadhaar,

- Update PAN details as per Aadhaar e-KYC,

- Create e-Filing account based on e-KYC details after allotment / updation of PAN, and

- Check status of pending e-PAN request / Download e-PAN either before or after logging in to the e-Filing portal.

Who Can Apply for Instant e-PAN (Prerequisites)

- Individual who has not been allotted a PAN

- Valid Aadhaar and mobile number linked to Aadhaar

- User not a minor as on date of request; and

- User not covered under the definition of Representative Assessee u/s 160 of the Income Tax Act.

Check Instant E-PAN User Manual using the link – https://www.incometax.gov.in/iec/foportal/help/how-to-generate-instant-e-pan

Read frequently asked questions on e-PAN (FAQ’s) – https://www.incometax.gov.in/iec/foportal/help/e-filing-generate-instant-e-pan-faq